Midaxo Blog

Featured BLOG

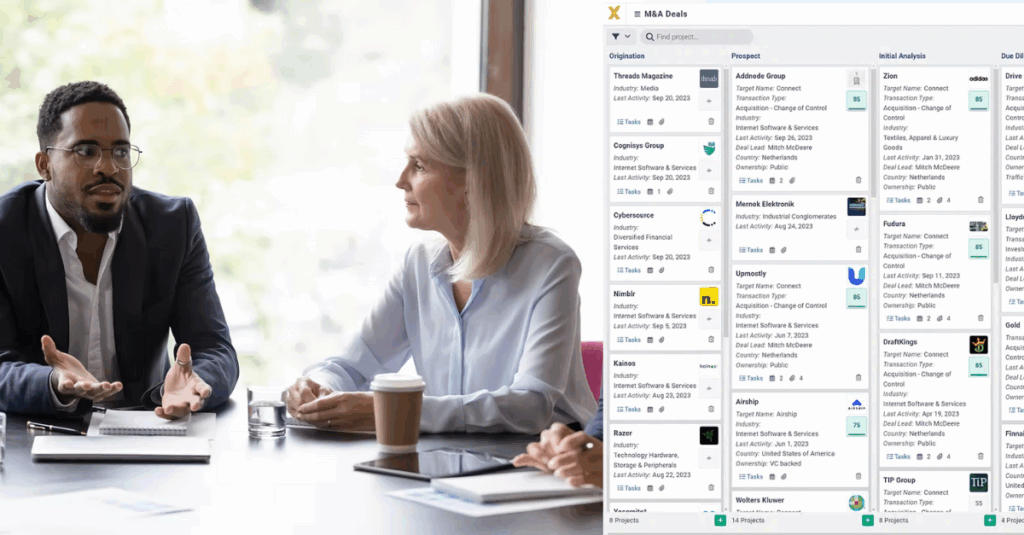

How Allstar’s M&A team saves time & closes more deals with Midaxo

For Alex Whitley, Director of Corporate Development at Allstar Services, driving multiple deals a year is made far easier by using a purpose-built software platform. “You get pretty good at formatting Excel to make a pipeline look presentable…but it’s not exactly user-friendly.” Alex recalls. By transitioning to Midaxo, Allstar Services unlocked faster processes and a …

Latest Posts

Three pillars of better M&A diligence

Due diligence is the heartbeat of any M&A deal. Done right, it gives buyers the confidence to move quickly, make the right bid, and build …

M&A deal origination & screening: poll results reveal the gaps—and opportunities

During our recent webinar on Digitizing Your M&A Deal Pipeline, we asked attendees to share their perspectives on the challenges they face in deal origination …

Wise Financial Consulting: bringing M&A intelligence to both buy- and sell-side deals with Midaxo

Ken Wiesenfeld has been in the trenches of M&A long enough to know what drives success—and what derails it. As a CFO leading acquisition-fueled growth …

The technology portfolio companies need to become an M&A powerhouse

Execution is your competitive edge. Hone it with the right process and platform. In Private Equity-backed growth, the pressure to move fast—and execute flawlessly—is relentless. …

How Leap Partners is staying laser-focused to close more deals and grow faster

Leap Partners is scaling fast. The Southeast’s premier home services company, Leap Partners is closing an average of one acquisition per month. Driving that growth …

How top PE firms win by supporting process-driven M&A execution

The technology Private Equity needs to cultivate a portfolio of M&A powerhouses In today’s deal environment, access to capital is not necessarily the main differentiator. …

Other Resources

Learn How Midaxo Can Power Your Dealmaking

Contact us for a live demo or simply to discuss how Midaxo can improve the productivity of your team