Midaxo Blog Archive

Latest Posts

6 Reasons Private Equity Firms Are Having Their Best Year Ever

Introduction: If you operate in the world of finance, business, or mergers and acquisitions, you’ve noticed that private equity (PE) activity is at a record …

IPO Checklist: Preparing to Go Public

I. Setting the StageUnderstanding your IPO rationale and its implications Understanding the pros and cons of going public, and understanding the long-term implications of doing …

The Value of End-to-End Security in M&A

Introduction: Picture this: you are an acquirer feeling pretty confident about your next target, but before moving forward, you bring in a security expert to …

Holistic M&A: Why It is Needed Now More Than Ever

Introduction: As Corporate Global Executive and writer Pearl Zhu says, “Holistic Thinking is a combination of analysis, systems thinking, and critical thinking.” However, as Mergers …

4 Important Steps for Proactive IPO Planning

Introduction More companies went public in 2020 than any other year so far in the 21st century. From Roblox, to The Honest Company, to Poshmark, …

Extracting Deal Value & Fighting Value Erosion

Introduction: Value creation starts earlier than you think; it begins with an overarching M&A strategy for inorganic growth, which allows you to identify the most …

The Importance of Incorporating Value Creation Early in the Deal Lifecycle

Why do deals fail? Well, human nature and outside factors can certainly play a role, but often the problem primarily lies in the execution of …

Expert Views: 3 Best Practices for Tailored and Effective Integration

Integration remains one of the most talked about aspects of M&A, yet successful integration still alludes many acquirers. This can be due in part to …

The Three Keys to Post Merger Integration

Introduction: Despite the complexity of Post-Merger Integration (PMI), the process often does not receive the attention it deserves. This neglect unfortunately can contribute to the …

Expert Views: Improve Your Target Selection For Cleaner Deals

In our recent M&A Chat interview with David Lewis, when reflecting on his extensive experience in the worlds of finance and M&A, he notes he would tell his …

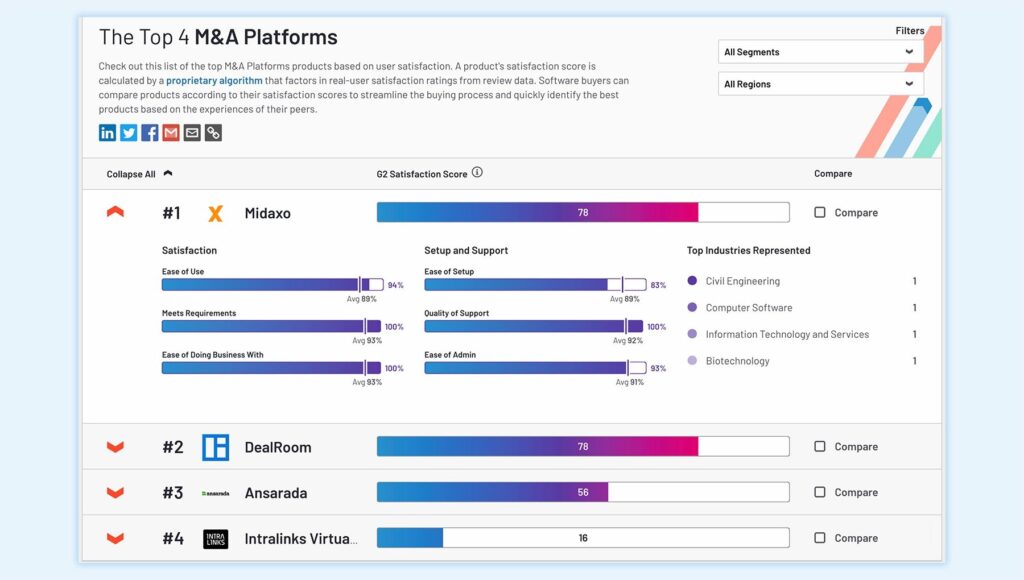

Midaxo Rated #1 M&A Platform on G2

Midaxo is proud to announce it is currently the top M&A platform on G2 based on user reviews, outranking M&A platform competitors such as Intralinks, DealRoom, and …

The ROI of M&A Software Solutions

Introduction: I recently participated in a M&A Leadership Council conference focused on realizing the return on investment (ROI) of M&A Software Solutions. The Council did …

CREO’s Key Factors for Right Sizing Your Post-Merger Integration

Introduction: The risks of not right sizing your integration span from stunted growth to missed opportunity and frustration. For instance, if you oversize your integration …

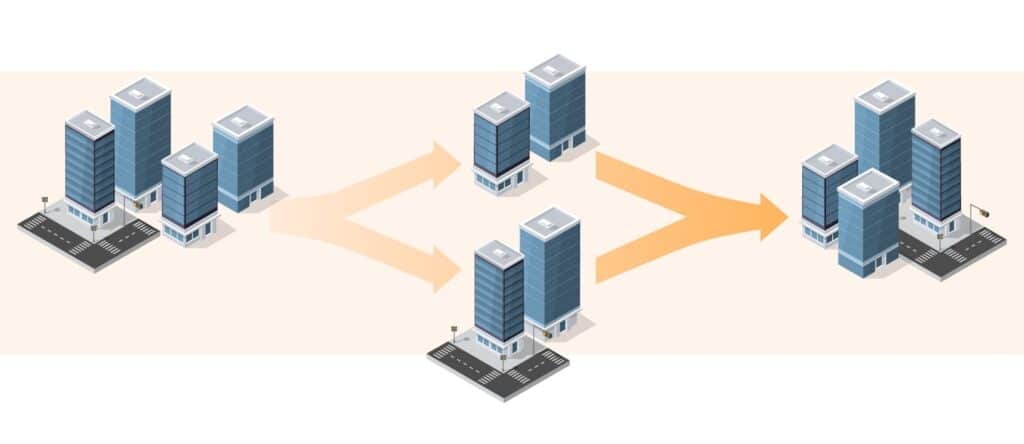

Roll-Up Strategies & The Right M&A Software Solution

Introduction: Roll ups are predicted to be a significant part of M&A strategy in 2021. Historically, they have faced both praise and criticism from industry …

Lessons Learned From Global Separation and Integration Programs: Best Practices with KPMG

Introduction: Before we dive into best practices and insights on global separations and integration programs, we must first set the scene. While no separation is …

Talent Retention in M&A: 5 Best Practices

Introduction: So-called “soft skills,” those related to emotional and social intelligence, as well as leadership traits/styles, were deemed by employers to be some of the …

A Look Back & A Look Ahead: M&A Activity in 2020 and 2021 Preview

Introduction: In March 2020, as COVID-19 crippled our lives and the economy, M&A deal volume plummeted. Due to the pandemic’s uncharted territory, most deals halted. …

The Top M&A Software Providers of 2020

Introduction: While M&A processes have not radically changed over the last few decades, we cannot deny the sweeping rise of M&A software, which has gained …

6 Overarching Best Practices for Post-Merger Integration in 2021

Introduction: Research studies cited by Deloitte suggest that one of every two post-merger integration (PMI) attempts is categorized as “poor” or failing, which is quite …

Which VDR Features Do You Need for Your M&A Process?

Why Choosing the Right VDR is Critical for Deal Success Security, collaboration, efficiency, and real-time visibility are non-negotiables when crafting an effective M&A process. Whether …

Fight M&A Failure With The Three Building Blocks of Change Management

Introduction: M&A happens because companies believe there is an intrinsic benefit to be had from deal-making, but failure or underperformance happens time and again because …

Other Resources

Learn How Midaxo Can Power Your Dealmaking

Contact us for a live demo or simply to discuss how Midaxo can improve the productivity of your team